GST has been a hot topic among Malaysians for a while now.

We often hear talk of how goods and services are getting expensive because of GST, how GST has been a drag to the economy and how GST is burdensome to businesses and consumers and so on.

But we often missed the bigger picture of the benefits that GST has brought to the government, the people and the economy as a whole.

As you may well already know, crude oil prices had plunged from its peak of $114 per barrel in June 2014 to as low as $29 per barrel in January earlier this year before it recovered to $48 per barrel presently.

|

| Brent Crude Oil |

As a result government petroleum related revenue decreased sharply last year:

|

| Government Petroleum Related Revenue |

In absolute term, government petroleum revenue dropped by RM20 billion in 2015 compared to 2014.

In relative term to Malaysia’s government total revenue, petro-revenue dropped from 34% of total revenue in 2010 to 19.90% of total revenue last year:

In relative term to Malaysia’s government total revenue, petro-revenue dropped from 34% of total revenue in 2010 to 19.90% of total revenue last year:

|

| Government Petroleum Related Revenue |

The most visible drop in petro-revenue was the Petroleum Income Tax (PITA) which is charged to income derived from upstream operations at the rate of 38%.

|

| Petroleum Income Tax (PITA) Collection (Annually) |

Last year, government collected PITA amounting to RM11.55 billion as opposed to RM27 billion collected in 2014, a drop of almost 60% year on year.

|

| Petroleum Income Tax (PITA) Collection (Half Yearly) |

In the first half of 2016 (Jan-Jun 2016), PITA collection dropped by 52% compared to the same period last year (Jan-Jun 2015) and dropped by 76% compared to the first half of 2014.

RM20 billion loss of revenue in 2015 is amounting to 10% of total government revenue.

That’s a significant amount as RM20 billion is almost half the size of Ministry of Education annual operating budget.

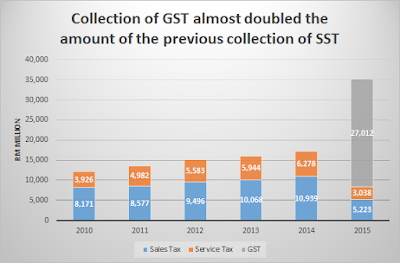

Now let’s take a look into government indirect tax collection particularly consumption tax which are sales tax, service tax and GST that replaced the former two taxes:

|

| Consumption Tax Collection |

Pre-GST era, collection of both sales tax and service tax was around RM12 billion in 2010 to RM17 billion in 2014.

In 2015, the amount of consumption tax collected by the government jumped sharply to RM35 billion after the implementation of GST (3 months of sales and service tax and 9 months of GST):

|

| Consumption Tax Revenue to Total Government Revenue Ratio |

Percentage of consumption tax to total government revenue also jumped from average 8% (from 2010 to 2014) to 16% in 2015.

GST brought in RM18 billion extra revenue on top of what was collected (SST) before it was implemented in April 2015.

The amount of GST collected by the government, has almost offset the RM20 billion loss in petro-revenue:

|

| Petroleum and Consumption Tax Revenue |

As you can see from the chart above, petro-revenue dropped to RM43.6 billion in 2015 from RM64.06 billion in 2014 while consumption tax (SST and GST) revenue increased from RM17.2 billion in 2014 to RM35.27 billion in 2015.

Sales and service tax which are a single-stage tax wouldn’t have offset the RM20 billion loss in petro-revenue.

Had GST not implemented last year, government would have a shortfall of RM20 billion in revenue.

Government budget deficit would have shot up to RM57 billion instead of RM37 billion recorded last year and deficit to GDP ratio would have been 6% instead of 3.2% had it not for GST implementation.

It’s as clear as a bell that GST has saved the government finance but how did GST save our economy?

Economic activity or economy size or GDP consists of private consumption, government consumption, gross fixed capital formation (public and private investments), changes in inventories and net exports (exports minus imports):

|

| GDP by Expenditure Components |

Malaysia’s government consumption expenditure consists of 13.5% or RM143 billion of GDP in 2015.

If GST hadn’t been implemented, government consumption expenditure would have contracted and SMALL percentage point of GDP would have been shaved off because of the loss in petro-revenue.

Malaysia's government is practicing unwritten law that government operating expenditure (government staff salary, pension, subsidy, debt service charges, asset acquisitions, grants, transfers etc) must be financed by government revenue which means government would not borrow to fund its operating expenditure.

The last time government annual revenue could not cover annual operating expenditure was during the 1985-1986 economic crisis caused by sharp plunge in commodity prices.

While development expenditure (investments) is funded by borrowings (issuance of government securities).

The last time government annual revenue could not cover annual operating expenditure was during the 1985-1986 economic crisis caused by sharp plunge in commodity prices.

While development expenditure (investments) is funded by borrowings (issuance of government securities).

Contraction in government revenue would mean a reduction in operating expenditure.

If GST wasn’t implemented, government would have to cut its operating expenditure more than it had cut last year and this year.

That means, less subsidy, less cash transfers, no bonuses or salary hike for government staff and many more cuts in budget which would also result in slower economic activity or GDP growth.

GST has been proven as a saviour of the government finance and also the Malaysia’s economy.

GST collected by the government was spent for the people and flowed back to the people in the form of cash transfers (BR1M), healthcare subsidy (government hospitals and clinics), education (public schools and universities) and many more.

GST hasn’t really burdened the masses as alleged by certain quarters because most of the basic goods, services and amenities are charged at zero-rate and exempted by the government.

GST is also a form of re-distribution policy, from the top income group to the bottom and middle income group.

The rich spend more money on luxury and imported items while the low and middle income group spend more on basic necessities which as I stated earlier are zero-rated and exempted from GST.

The rich spend more money on luxury and imported items while the low and middle income group spend more on basic necessities which as I stated earlier are zero-rated and exempted from GST.

We always complain about how GST has burdened us all, made us poorer and all that we overlooked the benefits that GST has brought to our economy.

Even the complaint that GST has made goods and services become more expensive is not entirely accurate as I explained (in Malay) here.

Nobody could have predicted that oil prices would fall by more than 70% and The Prime Minister and the government were right to implement the GST despite of its unpopularity among Malaysians.

GST implementation was timely and might have prevented a deeper economic slowdown in our country.

I’m not asking all of us to be grateful or to praise the government but we need to be fair and at least acknowledge the fact that GST has brought more good than harm to us, the government and the economy.

1. Malaysia Government Revenue - Bank Negara Monthly Statistical Bulletin

2. National Account - Bank Negara Monthly Statistical Bulletin

No comments:

Post a Comment