Apparently Tony Pua cannot stop blabbering on and on about Ringgit depreciation against US Dollar.

A couple of weeks ago I wrote a rebuttal post to Tony Pua's comment on Ringgit and to date I have yet to receive any response from him.

This week he came up with a piece on Malaysiakini asking whether 2017 will bring relief and recovery for the Ringgit. [1]

He's basically repeating the same points again and again and commenting on some stuffs he himself apparently doesn't have any idea about.

Let me rebut his piece paragraphs by paragraphs so bear with me:

"While 1MDB and Prime Minister Najib Abdul Razak’s alleged kleptocratic scandals were unquestionably the most talked about topics in 2016, it is the ringgit’s relentless depreciation that would have caused the most pain for ordinary Malaysians.

Over Christmas, I managed to take my family for a week’s holiday in Chiang Mai in Thailand - our first since I was banned from overseas travel for allegedly taking part in “activities detrimental to parliamentary democracy” in July 2015.

One would have assumed that travelling to the ‘backwaters’ like rural Thailand would have been easy on the pocket. Well, in the past, trips to Thailand did make me feel ‘richer’. When you walked the colourful and rambunctious street markets, you needed to exercise maximum self-restraint to prevent oneself from having to purchase additional luggage space from AirAsia because everything was ‘cheaper’.

Not anymore. Now, the baht-ringgit exchange rate will automatically keep you disciplined.

As late as August 2014, the currencies were trading at 10 baht to the ringgit. Today, it’s eight to one. And to rub salt on the wound, the ringgit isn’t particularly welcomed by our neighbours.

Needless to say, if a trip to Thailand could make you feel kinda poor, a journey south to Singapore would make you feel like a destitute person. Think about it, a budget Hotel 81 room in the fringe of the city would cost you just about S$100, or RM310 per night."

First he said Ringgit depreciation caused the most pain for ordinary Malaysians, next he talked about a vacation overseas.

Most ordinary Malaysians cannot even afford to travel domestically, let alone abroad.

According to the Household Expenditure Survey 2014 by the Department of Statistics Malaysia, the Middle 40% (M40) and Bottom 40% (B40) income group spent only RM72 and RM12 respectively for accommodation service (hotels) annually while the Top 20% (T20) spent RM648 annually. [2]

|

| Household Consumption Expenditure by Income Group: Household Expenditure Survey 2014 |

Obviously Tony is in the T20 who could afford to go on vacation abroad every year and make fun of his own country while vacationing but he's in no position to talk as if he represents the ordinary Malaysians which are the M40 and B40 group.

Tony failed to mention that Ringgit has depreciated against Thai Baht in recent years because of falling crude oil prices.

According to International Energy Agency (IEA) in its World Energy Outlook 2015 report, Thailand is the largest oil and gas importer in this region and is set to benefit from biggest reduction in its import bill. [3]

|

| World Energy Outlook 2015: IEA |

Bloomberg also reported that Bank of America (BofA) saw Thailand as among biggest winners from oil drop [4]:

|

| Bloomberg |

As Thailand's import bill decreased amid falling crude oil prices, its current account (exports minus imports) balance increased and in contrast Malaysia as the only net exporter of oil and gas that floated its currency in this region saw its current account balance decreased in recent years:

|

| Malaysia and Thailand Current Account Balance % of GDP: World Bank |

This is why Ringgit depreciated against Baht since the end of 2014 until today.

Yes crude oil price has rebounded by the end of 2016, but on average crude oil price in 2016 (US$44 per barrel) was still lower than in 2015 (US$54 per barrel) and we won't see immediate positive impact from the recent bounce on Malaysia's exports revenue and current account surplus as there's a lag between current price and exports revenue.

If crude oil price sustains its current upward trajectory throughout this year, we'll see Ringgit appreciates against Baht as we've seen before.

Ordinary Malaysians won't go to Singapore for leisure activities and definitely won't be affected by Singaporean Dollar (SGD) appreciation against Ringgit.

Nonetheless, Tony still failed to mention to us that SGD appreciates against Ringgit because of its own monetary policy to maintain a modest and gradual appreciation path of the Singapore Dollar against a basket of currencies of its major trading partners and competitors.

Unlike our Bank Negara Malaysia (BNM) which uses interest rates setting as the monetary policy operating instrument, Singapore central bank, Monetary Authority of Singapore (MAS) monetary policy has been centered on the management of exchange rate.

MAS main and final objective of exchange rate management is price stability which is low and stable inflation rate.

As Singapore imports most of its consumption needs from other countries such as Malaysia, they would want a continuously strengthening currency against its import source countries including our own Ringgit.

That's why ever since Malaysia exited the currency interchangeability agreement (RM1 = SGD1 = BND1) in 1970, Singapore Dollar appreciated against Ringgit continuously. [6]

|

| SGD/MYR Exchange Rate: BNM |

|

| Singapore's Exchange Rate-Based Monetary Policy |

Why did Tony hide this fact to his readers? As an Oxford graduate in philosophy, politics and economics (PPE) he should know better than most ordinary Malaysians.

According to this article from Guardian, PPE students study all three philosophy, politics and economics equally in the first year and they can choose to drop one subject in the second year. [7]

|

| Is PPE A Passport to Power: Guardian |

So Tony, did you drop your "E" after your first year at Oxford?

"So, will we get to see some desperately yearned for relief and recovery of the ringgit this year?Most pundits are telling us that the ringgit is undervalued and will recover by the second half of this year. Public Invest Research said the ringgit will recover to average between 4.10 and 4.15 for 2017 against the US dollar, which is currently trading at 4.48.Najib would similarly like you to believe that the ringgit will recover.“With the recent changes and developments, we are confident the ringgit will recover. It is due to speculation by outsiders and the uncertainties in the United States that the ringgit dropped, and not because the ringgit is weak,” Najib said in December, when the ringgit traded at 4.42 to the dollar.But didn’t they all say the same thing last year? Or for that matter, the year before?The prime minister told us, way back in January 2015, that the ringgit would bounce back from the then five-year low versus the US dollar as “Malaysia’s financial market is sufficiently robust”. Believe it or not, the ringgit was then trading at 3.60 to the dollar, which now seemed like a parallel universe away."

As the Prime Minister of course Najib would want to reassure investors that Ringgit will recover in the future, what else would you expect?

And rightly so Ringgit did recover against US Dollar significantly in the first four months of 2016:

|

| USDMYR in 2016: Bloomberg |

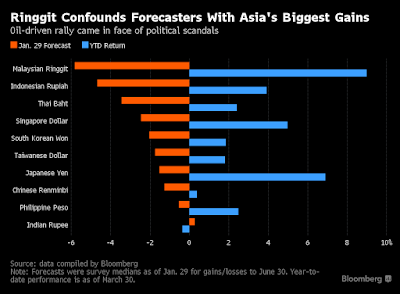

Ringgit appreciated against the greenback by more than 13% from 4.40 to 3.86 and was the best performer in Asia in the first quarter of 2016 defying forecasters' forecast as reported by Bloomberg [8]:

And around May, US Dollar started to appreciate again and all gains registered by Ringgit in the first four months had been erased by the end of 2016 despite the rebound in crude oil prices last year.

The reversal of USD/MYR could be attributed to other factors that still lingering in the financial markets in 2016 such as the Yuan depreciation throughout 2016 which started significantly around May 2016:

|

| USD/CNY: Bloomberg |

Then in November Donald Trump unexpectedly won the US presidential election and sent shivers across the global financial markets especially the emerging markets.

Ringgit was particularly affected and reacted negatively to Trump's triumph and depreciated sharply against US Dollar from 9th November until the end of the year:

|

| USD/MYR: Bloomberg |

These external factors are beyond Najib's or government of Malaysia's or anyone's control for that matter.

"If we had all trusted our ministers and invested based on his financial advice, some of us would be having borderline suicidal tendencies today. 2016 was the ringgit’s fourth consecutive year of decline against the US dollar."

Logically, if you buy a stock in Bursa Malaysia, you would trade it in Ringgit and gain or lose money in Ringgit and exchange rate wouldn't affect your gains or losses.

If you are a smart investor, you would buy an export-oriented stocks when Ringgit depreciated as recommended by The Edge two years ago. [9]

Even so, most ordinary Malaysians don't invest directly in the stock market or any other fancy investment instruments.

They would invest in something simpler like unit trusts such as funds under Permodalan Nasional Berhad (PNB), government linked funds such as Tabung Haji, Koperasi Bank Rakyat or private unit trusts like funds under CIMB Principal Assets, Public Mutual and others.

For PNB funds, Tabung Haji, Koperasi Bank Rakyat all paid dividends to their unitholders without fail so most ordinary Malaysians' investments are not affected by Ringgit depreciation.

"The thing is, if everyone else had declined at the same rate against the dollar, it wouldn’t have felt so bad. What is particularly galling is that the ringgit’s performance is the worst among all the major regional currencies.In 2015, the excuse given was straightforward - the ringgit suffered more because we were an oil-exporting nation. As the price of global crude collapsed from US$102.10 in January 2014 to US$60.70 (December 2014) to US$36.57 (December 2015), it is almost understandable that the ringgit would be disproportionately pummelled.

The pundits had predicted that the ringgit would recover with the recovery of oil prices last year. They were indeed spot on in their prediction of higher oil prices with the Brent crude trading at US$55 a barrel by December 2016. Unfortunately, despite the oil price reversal, the ringgit value worsened significantly.

How was that even possible?"

The reason why Ringgit was the worst among the major regional currencies is pretty simple.

We are the only net exporter of oil and gas in this region that floated its currency while Brunei is also a net exporter of oil and gas, its currency Bruneian Dollar (BND) follows Singaporean Dollar (SGD) under the Currency Interchangeability Agreement I mentioned above so BND didn't depreciate like Ringgit.

Although Brunei's currency remained stable amid plunging crude oil price, its GDP has been contracting since 2013 or in other words Brunei has been in economic recession since 2013 or Brunei's economy has been shrinking since 2013 [10]:

|

| Brunei GDP Growth: IMF World Economic Outlook 2016 |

Other regional countries are all net importer of oil and gas so they benefited from the fall in crude oil prices as their cost of imports decreased significantly.

As I explained earlier there's a lag between oil prices and its effect towards Malaysia's exports revenue, current account balance and also government's petroleum revenue.

Also on average, crude oil price in 2016 was actually lower than average crude oil price in 2015 as it only rebounded above US$50 per barrel by fourth quarter of 2016:

|

| Average Annual Brent Crude Oil Price: Statista |

We will only see the benefit of crude oil rally in the first half of this year and by then if crude oil rally is sustained, Ringgit will see a sharp rebound just like in the first quarter of 2016.

Tony didn't know this? How was that even possible?!

"Back in November 2015, the then-Bank Negara governor, Zeti Akhtar Aziz, told an international audience that the ringgit was “significantly undervalued” as our “export growth remains fairly strong”.

Except it wasn’t.

Conventional economic theory tells us that as our currency gets depreciated, our goods become cheaper and consequently, the demand for them increases. A robust increase of the export of our goods and services would in turn increase the demand for our currency and hence provide a strong platform for the recovery of our ringgit and economy.

Well, the ringgit was massacred in 2015 when it depreciated by nearly 20 percent. On paper, that makes our exports dirt cheap in 2016. And given that we have always prided ourselves as an export-oriented economy, our goods should definitely be flying off the shelves as they became extremely competitive.

But the government’s own statistics tell us that our exports barely eked out a gain. The 2016/2017 Economic Report published in October 2016 tells us that our Gross Exports for January to August 2016 grew by only 1.1 percent, compared with 1.6 percent in 2015.

More specifically, the electrical and electronics exports, the pride of our manufacturing industry, grew by only 2.2 percent, a substantial decline from 7.4 percent in 2015. While 2.2 percent might have been just about acceptable under normal economic circumstances, the number is pathetic given the depreciation the ringgit suffered.

Worse news followed since the above report, when the Department of Statistics disclosed last month that our exports declined 3.0 and 8.6 percent for the months of September and October respectively."

This is at best, amateurish analysis of Malaysia's exports by Tony.

Our exports barely eked out a gain, but we are among the top performer this year and gross exports for January to November 2016 grew by 0.2% as opposed to regional countries China, Japan, South Korea, Hong Kong and Taiwan which exports growth were negative for the same period:

|

| Malaysia External Trade Statistics: MATRADE |

Even in 2015, among all major regional countries, Malaysia was the only country other than Japan that recorded a positive growth of 1.6% in exports.

China, South Korea, Hong Kong, Taiwan and Thailand all recorded negative growth in exports in 2015.

Our electrical & electronics (E&E) exports recorded a highest growth of 8.5% in 2015 the year that Ringgit was massacred in Tony Pua's words.

|

| Gross Exports of Manufactured Goods (Annual Change): BNM |

Yes, this year's E&E exports are not as robust as last year's but it still shows a positive growth where in January to October 2016 (RM234.45 billion), Malaysia's E&E exports grew by 1.9% compared to exports in January to October 2015 (RM230.01 billion).

Had Tony been patient a day longer, he could have read the latest Malaysia's external trade report by Department of Statistics Malaysia (DOSM) that shows Malaysia's exports rebounded by 7.8% in November after contracted in September and October.

Of course Tony would love to highlight the negative and deliberately overlooked the positive things.

In September and October 2016 when Malaysia's exports shrunk by 3.0% and 8.6% respectively other regional exporters' exports also contracted.

In September and October, China's exports declined by 10.2% and 7.4% respectively, Japan's exports plunged by 7.0% and 10.3% respectively and South Korea's exports dwindled by 6.1% and 3.5% respectively.

Yes, the depreciation of Ringgit hadn't boosted Malaysia's exports as much as it used to, but it certainly prevented Malaysia's exports from contracting like other regional exporters whose currencies didn't depreciate as much as Ringgit.

The question that we all should ask is not "why Ringgit depreciation hadn't boosted Malaysia's exports?" instead it should be "how has Ringgit depreciation helped Malaysia's exports from plunging like other regional countries?"

"Separately, the latest Nikkei Malaysia Manufacturing Purchasing Managers’ Index, or PMI, which measures manufacturing activities, shows the sector to be “in contraction territory for 21 consecutive months”.

The headline PMI posted for December was 47.1, signalling continued deterioration. A score above 50.0 signals improvement in manufacturing conditions, and Malaysia has not reached a score of 50.0 since early 2015."

Let me rephrase Tony's slightly misleading sentence, "... the latest Nikkei Malaysia Manufacturing Purchasing Managers' Index, or PMI, which measures SURVEYS of PURCHASING MANAGERS in the manufacturing sector...".

Manufacturing PMI are monthly surveys of purchasing managers in the manufacturing sector not the manufacturing activities itself:

|

| Product Summary: IHS Markit |

While Tony could use data from DOSM for external trade, I wonder why didn't he use data from DOSM for manufacturing activities?

Every month DOSM published a report called Monthly Manufacturing Statistics (MMS) which reports sales value, numbers of employees and salaries & wages in the manufacturing sector in Malaysia.

While Nikkei Malaysia Manufacturing PMI reported 21 months of contraction in manufacturing condition, October 2016 MMS reported an increase in sales value in manufacturing sector since July 2016 [11]:

|

| Sales Value in Manufacturing Sector, Monthly Manufacturing Statistics: DOSM |

Which report is more important and accurate? A survey of OPINIONS among purchasing managers or an actual statistics of manufacturing activities?

This shows Tony Pua's habit of cherry picking any bad news to paint negative image to his own country's economy.

"There is no question that our economy is suffering from something chronic that needs immediate treatment. Alarm bells should have been blaring deafeningly in Putrajaya, but all we get is ministers with their heads in the sand.

Prime Minister Najib welcomed 2017 by boasting that Malaysia has achieved a growth rate the Western world can only “dream of”.

“Our estimated growth rate of 4.3 to 4.5 percent for this year is one that developed countries in Europe and North America can only dream of. Malaysians should be proud of the growth we are achieving.”

A statement from the Barisan Nasional strategic communications team earlier in December also boasted that “Malaysia’s economic growth is less volatile and more robust than Singapore’s as a result of the Najib administration’s shift towards the domestic economy.”

Of course, the fact that developed countries have a different growth trajectory compared to developing ones was irrelevant. What was more important to the ruling leadership was the continued thumping of the chest to praise and glorify the Emperor in the eyes of seemingly gullible Malaysians, even if the Emperor is really naked.

So what’s really happening?"Our economy is suffering from something chronic that needs immediate treatment? Suffering from what exactly? Despite the deep plunge in commodities prices in 2015 that caused Ringgit been massacred, our economy as measured by gross domestic product (GDP) still grew by 5.0%:

|

| Malaysia's GDP Annual Growth: BNM |

For 2016, in the first 9 months of the year, GDP grew by 4.1% despite all the negative image painted by the opposition.

International Monetary Fund (IMF) findings stated that Malaysia's economy continues to perform well supported by domestic demand [11].

|

| IMF Staff Statement on Malaysian Economy |

What caught my attention is not much that Malaysia's GDP growth comment, but the acknowledgement by IMF that exchange rate flexibility has helped Malaysia weathered external challenges:

|

| IMF Statement on Malaysian Economy |

IMF is practically saying that Ringgit depreciation helped our economy cushioned the impact from the plunge in commodities prices.

How did Ringgit depreciation buffer the real economy from the commodity price shock?

Situation 1 (Oil at $100 and USD/MYR at 3.00):

- Crude oil price traded at US$100 per barrel

- USD/MYR traded at 3.00

- Exports revenue in USD term is US$100 and in MYR term is RM300

Situation 2 (Oil falls to $50 and Ringgit remains at 3.00):

- Crude oil price traded at US$50 per barrel

- USD/MYR traded at 3.00

- Exports revenue in USD term is US$50 and in MYR term is RM150

- Exports revenue in MYR term falls 50% as much as in USD term

Situation 3 (Oil falls to $50 and Ringgit depreciated to 4.00):

- Crude oil price traded at US$50 per barrel

- USD/MYR traded at 4.00

- Exports revenue in USD term is US$50 and in MYR term is RM200

- Exports revenue in MYR term falls by 33%

Which is more favorable situation 2 where oil price falls and Ringgit remains stable and Malaysia faces full loss of exports revenue or situation 3 where oil price falls and Ringgit depreciates and Malaysia's exports revenue loss partially offset by Ringgit depreciation?

That's what IMF meant about exchange rate flexibility as an automatic shock absorber to plummeting commodities price in recent years.

Countries who pegged their currencies to US Dollar faced the full loss of exports revenue like Saudi, UAE, Kuwait and other GCC countries.

This was the reason why Saudi Arabia's foreign reserves dropped by a staggering US$150 billion from its peak in 2014 [12]:

|

| Business Insider |

Still want a stable exchange rate amid falling crude oil price? Still want BNM to peg Ringgit to US Dollar?

Again Tony Pua as a PPE Graduate from Oxford should know this better than most ordinary Malaysians.

So what's really happening Tony?

"The anticipated explosive growth in exports and manufacturing activity as a result of persistent depreciation of the ringgit never materialised. Either no one wants to buy more Malaysian products, even though they are significantly cheaper, or more plausibly, businesses and investors are not investing in additional production capacity in Malaysia.

They are at best adopting the ‘wait and see’ strategy or at worst, have decided in investing their money in other countries. There could be many reasons for this, including perhaps a increasingly limited supply of skilled and quality labour, a weakening education system or the bureaucratic and corruption cost of doing business.

However, anecdotal evidence would tell you that one of the key factors is the fact that they have lost confidence in the country. A country led by a prime minister who has been indicted as allegedly one of the world’s biggest kleptocrats would and could never inspire confidence in genuine investors.

The complete failure of the institutional authorities to take enforcement actions against blatant and brazen corruption has destroyed whatever that’s left of Malaysia’s long-standing reputation as a country they could do business in."

Again Tony is factually wrong on businesses and investors are not investing as stated in Statistics of Foreign Direct Investment in Malaysia 2015, 30.4% or RM17.11 billion of FDI inflows in 2015 went into manufacturing sector an increase of more than 200% from just RM4.97 billion FDI inflows into manufacturing sector in 2014 [13].

|

| FDI in Malaysia, 2015: DOSM |

If businesses and investors are adopting "wait and see" strategy why are they still investing and why are there FDI inflows into manufacturing sector?

If there's no confidence among "genuine" investors towards Malaysia's economy why were they invested RM43.4 billion in FDI into Malaysia or is Tony accusing these investors as not genuine investors?

"Genuine" investors would know that Malaysia is among the best places for them to invest and make make money every year.

Foreign direct investors generated RM51.3 billion of FDI investment income in 2015 of which RM28 billion or 53.8% of the total FDI investment income in 2015 was generated from manufacturing sector.

"Genuine" investors would not want to miss the opportunity to invest and generate income in Malaysia and they certainly wouldn't want to listen to scaremongering by some quarters in Malaysia.

Malaysia's long standing reputation as a country investors could do business in remains intact as Malaysia's remains among the top in the ranking of Ease of Doing Business by World Bank ahead of many developed economies such as Switzerland, Netherlands, Belgium, Israel and many more. [14]

Shouldn't the complete "failure" of institutional authorities to take enforcement actions against blatant and brazen corruption chase away direct investors from investing in Malaysia?

The numbers and facts speak otherwise Tony.

"Bank Negara Malaysia is now forced to implement increasingly desperate measures to stem the tide against the ringgit. They now include the restricting the off-shore trade of the ringgit via non-deliverable forward contracts, and more controversially, the move to compel exporters to convert 75 percent of their proceeds into ringgit.

The central bank is claiming success for its policies, stating that the measures are starting to bear fruit, following lower volatility in the ringgit. Sure, such short term measures will provide immediate support for the ringgit as it mops up whatever excess liquidity existing today.

However, as explained earlier, Malaysia being an ‘export-oriented country’ is heavily dependent on continued investments in our export sectors, manufacturing or otherwise. If the use of your future export proceeds are restricted and the hidden cost of doing business in Malaysia increases, then who would want to invest in new or additional production capacity in the country?

Current exporters would not have a choice in the repatriation of export proceeds as demanded by the authorities. But they and future investors - both local or foreign - have a choice in where they choose to invest in the future. With alternative competing investment destinations aplenty today, such short-term Bank Negara measures will only further dampen the medium and longer term demand for the ringgit, jeopardising any eventual recovery."

Tony chose to look into measures that makes BNM looks like desperate but overlooked the fact that BNM is liberalising the onshore Ringgit hedging (forward) market to attract market participants to hedge their investments using forward instruments provided by onshore banks. [15]

|

| Press Statement by BNM Financial Markets Committee |

As for the 75% export proceeds repatriation and surrender requirements and Tony's thought that investors will shy away from Malaysia and have a choice to invest in other countries, he needs to know that 86 countries in the world have repatriation requirements and 60 countries have surrender requirements which include country like South Korea. [16]

|

| Annual Report on Exchange Arrangements and Exchange Restrictions: IMF |

Will these investors choose other countries to invest in as almost half of the countries in the world have exports repatriation requirements or exports surrender requirement?

As clearly stated in BNM Financial Markets Committee statement, the measures introduced by them are intended to enhance the liquidity of the foreign exchange (FX) market not to mop up liquidity.

There are people who will complain when the government or the authorities do something, and they will also complain if the government or the authorities do nothing and Tony Pua is one of them.

"We used to pride ourselves as an export and manufacturing powerhouse. We are used to being described as an “economically resilient” country, even if it was somewhat a function of striking the oil lottery, especially during the decade of high oil prices.

Unfortunately, the hard statistics are becoming hard to refute.

I would be foolish to give a specific prediction of how the ringgit will perform over the next three, six or 12 months, even as it hit 4.50 to the dollar yesterday, a new record low since the Asian Financial Crisis. However, it would be more than fair to say that the downside risks significantly outweigh the upside prospects, given the reasons explained above.

For Malaysians, perhaps it’s time to accept the new normal. We have lost more than 40 percent of our wealth in US dollar terms over the past three years. The lost of wealth will be reflected in higher prices of goods and services - including the higher price of petrol, as oil is traded internationally in dollars.

Although it is not impossible, this new normal will be extremely difficult to reverse. In fact, it more than likely to get worse, given the utter inability by the Najib administration to rectify the failures of the economy.

The only way Malaysians can hope for ‘the good old days’ to return is to see a change of regime. The new regime needs to cleanse the country of its kleptocratic reputation and wipe out the scourge of grand corruption from the government. It needs a new, intelligent economic team which isn’t encumbered by sacred cows decreed by those who are desperate to stay in power at all costs. It really isn’t rocket science.

Then perhaps, we will see a meaningful, significant and sustained recovery of the ringgit, and our wealth over the longer term."

We are still an export and manufacturing powerhouse at as far as I'm concerned as our performance in recent years were relatively better than regional exporters whose currencies didn't plummet as much as our own Ringgit.

In contrast to Tony, I believe that the upside potentials significantly outweigh the downside risks given the rebuttal to him above.

For (ordinary) Malaysians, they would not measure their wealth completely in USD term as it's a meaningless thing to do and most of Malaysians especially those in M40 and B40 groups don't even consume imported goods like the T20 group that Tony belongs to.

Higher prices of goods and services i.e. higher inflation has always been true even before Ringgit's depreciation started in 2014.

The recent increase in petrol prices are largely because of crude oil prices rally not because the depreciation of Rinngit.

Now the opposition use Ringgit's depreciation as their scapegoat to add to their scapegoat list like corruption, leakages, GST and many more.

And then there's this ridiculous fantasy that Ringgit will magically rebound if the opposition wins the next general election.

To date, I have never heard any of the opposition leaders who actually lays out a plan on how to stop Ringgit from depreciating and make Ringgit great again other than the recycled, unproven and unempirical theory that the change in ruling party in our country will make our Ringgit stronger.

We will see a meaningful, significant and sustained recovery of the Ringgit when all exogenous factors are on our side which is unlikely to happen in the near future.

Ringgit's depreciation is a cyclical "problem" that have happened in the past and will happen again and again in the future as external shocks will come and go.

As long as we don't react excessively like we used to during the Asian Financial Crisis in the late 90s, most people will not be affected by the fluctuation in exchange rates.

The most important thing is to make sure as many people as possible keep their jobs and earn income from their jobs.

May the day come where most people would rather have a weak currency than a weak economy and stop listening to some FX "tourists".

Will 2017 bring relief and recovery for the Ringgit?

I don't know and nobody knows.

But will 2017 bring sanity and serenity for Tony Pua?

I highly doubt it.

References: