"BR1M sebagai umpan untuk raih sokongan", begitulah hinanya golongan berpendapatan rendah dan menengah di bawah RM4,000 sebulan di kaca mata bekas Perdana Menteri Malaysia, Tun Mahathir.

Di dalam sebuah program yang dinamakan Program Bicara Rakyat yang diadakan di Alor Star semalam, Tun mengkritik Bantuan Rakyat 1Malaysia (BR1M) sebagai program yang diperkenalkan Najib Razak untuk meraih undi demi mencapai kemenangan di dalam pilihanraya yang akan datang. [1]

Ini bukanlah kali pertama Tun menyebut BR1M sebagai rasuah, umpan dan dedak kerana sebelum-sebelum ini pun Tun sudah banyak kali menyebut perkara yang sama di dalam blog dan siri ceramah beliau.

Ini bukanlah kali pertama Tun menyebut BR1M sebagai rasuah, umpan dan dedak kerana sebelum-sebelum ini pun Tun sudah banyak kali menyebut perkara yang sama di dalam blog dan siri ceramah beliau.

Tun terlalu terdesak untuk menyerang kerajaan sekarang sehingga menyatakan bahawa BR1M merupakan suatu kesalahan rasuah yang menyalahi undang-undang dan agama.

Sempat juga Tun memuji diri sendiri dengan mengatakan bahawa di bawah pentadbiran beliau dahulu tiada wang tunai diberikan kepada rakyat, tetapi kononnya kerajaan memberikan sistem jalanraya yang baik, peruntukan untuk sekolah yang mencukupi, biasiswa untuk pelajar dan sebagainya.

Terdapat juga tuduhan oleh Tun seperti ubat-ubatan di hospital kerajaan yang kononnya kini tidak lagi percuma dan perlu dibayar oleh rakyat sekiranya mereka mendapatkan khidmat rawatan di klinik dan hospital kerajaan.

BR1M diperkenalkan pada tahun 2012 dengan bayaran RM500 kepada isi rumah berpendapatan kurang daripada RM3,000 sebulan.

BR1M kemudiannya diluaskan kepada isi rumah berpendapatan di bawah RM4,000 pada 2014 untuk membantu golongan berpendapatan menengah. [2]

Di bawah adalah carta jumlah BR1M yang diagihkan dan bilangan penerima BR1M sejak 2012:

Setakat 2015, 7.4 juta isi rumah dan individu bujang menerima manfaat daripada bayaran BR1M yang melibatkan pindahan tunai berjumlah lebih RM5 billion bagi tahun 2015.

Tujuan utama BR1M diperkenalkan adalah untuk meringankan beban golongan berpendapatan di bawah RM3,000 sebulan selepas program rasionalisasi subsidi yang dijalankan kerajaan.

Sebelum BR1M diperkenalkan, kerajaan memberi subsidi kepada rakyat dalam bentuk subsidi pukal atau subsidi universal dalam bentuk barangan contohnya subsidi bahan api petrol dan diesel.

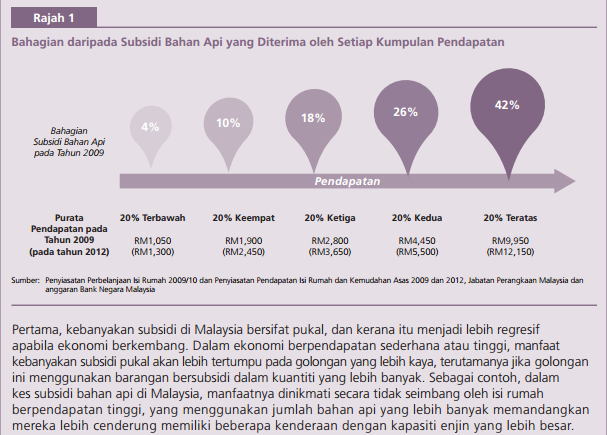

Subsidi seperti ini adalah subsidi yang regresif iaitu semakin tinggi pendapatan sesuatu isi rumah, semakin tinggi subsidi dinikmati oleh mereka.

Contohnya golongan berpendapatan tinggi yang memiliki kereta mewah, berkuasa tinggi mengisi petrol bersubsidi lebih banyak daripada golongan berpendapatan sederhana dan rendah yang hanya membawa kereta buatan tempatan, motorsikal dan tidak mempunyai kenderaan sama sekali.

Sebab itulah subsidi pukal seperti subsidi petrol sebelum ini bersifat regresif.

Bank Negara sendiri pernah mengeluarkan rencana bagaimana subsidi petrol lebih menguntungkan golongan berpendapatan tinggi daripada golongan yang berpendapatan sederhana dan rendah. [3]

BR1M kemudiannya diluaskan kepada isi rumah berpendapatan di bawah RM4,000 pada 2014 untuk membantu golongan berpendapatan menengah. [2]

Di bawah adalah carta jumlah BR1M yang diagihkan dan bilangan penerima BR1M sejak 2012:

|

| Jumlah BR1M yang Diagihkan dan Bilangan Penerima 2012 - 2015, Perbendaharaan Malaysia |

Setakat 2015, 7.4 juta isi rumah dan individu bujang menerima manfaat daripada bayaran BR1M yang melibatkan pindahan tunai berjumlah lebih RM5 billion bagi tahun 2015.

Tujuan utama BR1M diperkenalkan adalah untuk meringankan beban golongan berpendapatan di bawah RM3,000 sebulan selepas program rasionalisasi subsidi yang dijalankan kerajaan.

Sebelum BR1M diperkenalkan, kerajaan memberi subsidi kepada rakyat dalam bentuk subsidi pukal atau subsidi universal dalam bentuk barangan contohnya subsidi bahan api petrol dan diesel.

Subsidi seperti ini adalah subsidi yang regresif iaitu semakin tinggi pendapatan sesuatu isi rumah, semakin tinggi subsidi dinikmati oleh mereka.

Contohnya golongan berpendapatan tinggi yang memiliki kereta mewah, berkuasa tinggi mengisi petrol bersubsidi lebih banyak daripada golongan berpendapatan sederhana dan rendah yang hanya membawa kereta buatan tempatan, motorsikal dan tidak mempunyai kenderaan sama sekali.

Sebab itulah subsidi pukal seperti subsidi petrol sebelum ini bersifat regresif.

Bank Negara sendiri pernah mengeluarkan rencana bagaimana subsidi petrol lebih menguntungkan golongan berpendapatan tinggi daripada golongan yang berpendapatan sederhana dan rendah. [3]

|

| Bahagian Subsidi Api Mengikut Kumpulan Pendapatan |

Rencana yang dikeluarkan Bank Negara menyatakan bahawa isi rumah berpendapatan 20% terbawah (RM1,300 sebulan) hanya menikmati 4% bahagian subsidi bahan api manakala isi rumah berpendapatan 20% teratas (RM12,150 sebulan) menikmati 42% daripada bahagian subsidi petrol dan diesel.

Jika setiap tahun kerajaan memperuntukkan RM10 billion subsidi bahan api, hanya RM400 juta dinikmati golongan termiskin di dalam negara, tetapi RM4.2 billion dinikmati golongan terkaya dalam negara.

Adakah ini adil pada pandangan anda?

Oleh sebab itulah kerajaan memperkenalkan BR1M dan mengurangkan subsidi pukal secara berperingkat supaya pengagihan hasil negara itu lebih adil dan dinikmati mereka yang betul-betul memerlukan.

Kos untuk membiayai subsidi bahan api juga sangat tinggi setiap tahun berbanding kos membiayai BR1M.

Menurut Penyata Kewangan Kerajaan Persekutuan Tahunan, kos subsidi bahan api setiap tahun sejak 2010 adalah:-

2010: RM9.6 billion

2011: RM20.4 billion

2012: RM27.9 billion

2013: RM27.3 billion

2014: RM23.5 billon [4]

Manakala kos untuk membiayai BR1M tidak sampai separuh daripada perbelanjaan untuk subsidi bahan api iaitu hanya RM5.9 billion tahun ini (2016). [5]

BR1M juga mendapat pengiktirafan World Bank sebagai program pindahan tunai yang berjaya sampai kepada 90% golongan yang memerlukan dan juga diiktiraf sebagai sangat progresif dan bukannya regresif seperti subsidi petrol dan diesel berbentuk pukal. [6]

Di dalam laporan yang sama World Bank menyatakan bahawa BR1M merupakan penyumbang kepada penurunan kadar kemiskinan di Malaysia dan sekiranya BR1M dan bayaran kebajikan yang lain tidak dilaksanakan kadar kemiskinan di dalam Malaysia akan lebih tinggi daripada yang dicatatkan sekarang.

Jika setiap tahun kerajaan memperuntukkan RM10 billion subsidi bahan api, hanya RM400 juta dinikmati golongan termiskin di dalam negara, tetapi RM4.2 billion dinikmati golongan terkaya dalam negara.

Adakah ini adil pada pandangan anda?

Oleh sebab itulah kerajaan memperkenalkan BR1M dan mengurangkan subsidi pukal secara berperingkat supaya pengagihan hasil negara itu lebih adil dan dinikmati mereka yang betul-betul memerlukan.

Kos untuk membiayai subsidi bahan api juga sangat tinggi setiap tahun berbanding kos membiayai BR1M.

Menurut Penyata Kewangan Kerajaan Persekutuan Tahunan, kos subsidi bahan api setiap tahun sejak 2010 adalah:-

2010: RM9.6 billion

2011: RM20.4 billion

2012: RM27.9 billion

2013: RM27.3 billion

2014: RM23.5 billon [4]

Manakala kos untuk membiayai BR1M tidak sampai separuh daripada perbelanjaan untuk subsidi bahan api iaitu hanya RM5.9 billion tahun ini (2016). [5]

BR1M juga mendapat pengiktirafan World Bank sebagai program pindahan tunai yang berjaya sampai kepada 90% golongan yang memerlukan dan juga diiktiraf sebagai sangat progresif dan bukannya regresif seperti subsidi petrol dan diesel berbentuk pukal. [6]

|

Di dalam laporan yang sama World Bank menyatakan bahawa BR1M merupakan penyumbang kepada penurunan kadar kemiskinan di Malaysia dan sekiranya BR1M dan bayaran kebajikan yang lain tidak dilaksanakan kadar kemiskinan di dalam Malaysia akan lebih tinggi daripada yang dicatatkan sekarang.

Selain daripada World Bank, International Monetary Fund (IMF) juga mengiktiraf BR1M sebagai program jaringan keselamatan sosial yang memberi manfaat kepada golongan yang terdedah kepada kemiskinan. [7]

Saya tidak faham kenapa Tun berkata bahawa pada zaman beliau sebagai PM, beliau tidak memberi wang tunai kerana beliau membina sistem jalan raya yang baik, peruntukan kepada sekolah yang mencukupi, pemberian biasiswa dan sebagainya seolah-olah sepanjang pentadbiran Najib, beliau tidak membina jalan, tidak memberi peruntukan yang mencukupi kepada sekolah dan tidak memberi biasiswa kepada pelajar.

Mengikut statistik jalan persekutuan dan negeri, sejak 2009, panjang jalan raya di Malaysia bertambah dari 16,932.66KM kepada 19,822KM bagi jalan persekutuan dan 106,075KM kepada 199,015KM bagi jalan negeri. [9] [10]

|

| Statistik Jalan Persekutuan 2009 |

|

| Statistik Jalan Persekutuan 2015 |

Tahun lepas sahaja kerajaan membelanjakan RM40.5 billion bagi pendidikan dan jumlah ini meningkat daripada tahun-tahun sebelumnya:

|

| Perbelanjaan Kerajaan Persekutuan Untuk Pendidikan, 2015 |

Kos semasa bagi setiap murid setahun yang ditanggung kerajaan juga tertera di atas.

Tun Mahathir sediakan perbelanjaan yang mencukupi untuk rakyat, begitu juga Najib Razak.

Malah kerajaan sekarang juga menyediakan bantuan awal persekolahan berjumlah RM100 untuk ibu-bapa pelajar yang mempunyai pendapatan kurang RM3,000 sebulan [11]:

Pada tahun 2012 kerajaan memansuhkan sepenuhnya yuran persekolahan yang dikutip kementerian (tidak termasuk yuran PIBG) seperti diumumkan di dalam Bajet 2012. [12]

Soal pemotongan peruntukan kepada universiti-universiti awam dan pengurangan pemberian biasiswa juga tidak sepatutnya dijadikan isu kerana Tun sepatutnya faham pendapatan kerajaan terhad selepas harga minyak jatuh yang menyebabkan kerajaan kehilangan berpuluh billion hasil petroleum.

Walaupun GST berjaya menampung kekurangan hasil petroleum tersebut, tetapi ianya hanya sebahagian sahaja.

Tun tidak wajar lupa bagaimana ketika Malaysia dilanda krisis ekonomi, kerajaan di bawah pimpinan Tun juga memotong bajet universiti awam dan peruntukan biasiswa [13] [14]:

Lupakah Tun bagaimana 2,000 pelajar yang mendapat biasiswa ke luar negara dipanggil balik serta merta dan beribu-ribu lagi pelajar yang terpaksa membatalkan hasrat untuk melanjutkan pelajaran ke luar negara?

Lupakah Tun perbelanjaan universiti awam dibekukan sehingga tiada dana untuk membeli buku-buku baru?

Saya tak tahu di hospital kerajaan mana Tun pergi yang menyuruh pesakit membeli ubat sendiri.

Caj rawatan pesakit luar masih RM1 dan caj rawatan perkhidmatan pakar masih RM5 dan TIADA caj dikenakan untuk ubat-ubatan yang dibekalkan kepada pesakit seperti kenyataan media Ketua Pengarah Kesihatan Malaysia, Datuk Dr Noor Hisham Abdullah bulan lepas [15]

Bila agaknya kali terakhir Tun mendapatkan rawatan di hospital kerajaan sehingga Tun menyebarkan berita palsu ubat-ubatan di hospital kerajaan perlu ditanggung sendiri pesakit?

Keterdesakan Tun Mahathir semakin hari semakin jelas sehinggakan beliau sanggup menghina golongan berpendapatan rendah dan menengah sebagai penerima rasuah, mudah termakan umpan, tiada maruah dan sebagainya.

Ada anak Tun Mahathir yang mendapat kontrak berbillion-billion daripada Petronas untuk syarikatnya sendiri, bagaimana boleh beliau faham kehidupan isi rumah berpendapatan kurang RM4,000 sebulan.

Ada anak Tun Mahathir yang berniaga besar-besaran dan hampir bankrap akhirnya dibantu oleh syarikat perkapalan milik Petronas. [16]

Mana mungkin anak-anak Tun Mahathir pernah merasai pendapatan di bawah RM2,000 selaku individu bujang.

Tak lupa juga anak Tun Mahathir yang mendapat laluan mudah menjadi Timbalan Menteri dan kemudiannya Menteri Besar walaupun kalah pemilihan parti sebelum itu.

Tidak mungkin sama sekali Tun Mahathir faham bagaimana hidup sebagai golongan berpendapatan rendah dan sederhana.

Usaha kerajaan untuk membantu golongan-golongan ini sepatutnya disokong bukannya diperkecilkan dan dihina semata-mata kerakusan untuk menjatuhkan tampuk pimpinan kerajaan sedia ada.

Jika benar BR1M rasuah, apakah subsidi pukal yang tidak menguntungkan golongan berpendapatan rendah seperti subsidi petrol dan diesel legasi Tun Mahathir berpuluh tahun dahulu?

Jika BR1M itu salah dari segi undang-undang adakah segala jenis bantuan tunai yang diberikan oleh kerajaan negeri Selangor dan Pulau Pinang itu melanggar undang-undang negara?

Rakyat kebanyakan mungkin tidak mampu bermewah menaiki jet peribadi, bercuti ke luar negara seperti Tun sekeluarga, tetapi janganlah menghina mereka yang mendapat bantuan kerajaan sebagai penerima rasuah, senang diumpan dan pemakan dedak.

Sekurang-kurangnya golongan ini dapat merasai hasil kemakmuran dalam bentuk pendapatan tambahan dan bukannya dalam bentuk menara tertinggi dunia, litar lumba, pusat pentadbiran kerajaan baru seperti dulu kala.

RUJUKAN:

[1] "BR1M Umpan Raih Sokongan Rakyat" - Sinar Harian

[2] Laporan Ekonomi Malaysia 2016/2017 - Perbendaharaan

[3] Laporan Tahunan Bank Negara Malaysia 2014

[4] Penyata Kewangan Kerajaan Persekutuan - Jabatan Akauntan Negara

[5] Ucapan Bajet 2016 - Perbendaharaan Negara

[6] Malaysia Economic Monitor: Toward A Middle Class Society - World Bank

[7] IMF Country Report - Malaysia (March 2015)

[8] Variations in Household Propensity to Consume Across Income Segment - Bank Negara

[9] Statistik Jalan Persekutuan 2009 - Jabatan Kerja Raya

[10] Buletin Perangkaan Sosial 2016 - Jabatan Perangkaan Negara

[11] Ucapan Bajet 2017 - Perbendaharaan Negara

[12] Ucapan Bajet 2012 - Perbendaharaan Negara

[13] Malaysia Cuts Overseas Study - Times Higher Education

[14] The Impact of Economic Crisis on Higher Education in Malaysia

[15] Kenyataan Akhbar KPK 14 November 2016: Pengemaskinian Caj Rawatan Hospital KKM: Hanya Untuk Caj Pesakit Dalam Kelas 1 dan 2

[16] MISC to Pay $220 Million Price For Assets From Mahathir's Son - WSJ

[2] Laporan Ekonomi Malaysia 2016/2017 - Perbendaharaan

[3] Laporan Tahunan Bank Negara Malaysia 2014

[4] Penyata Kewangan Kerajaan Persekutuan - Jabatan Akauntan Negara

[5] Ucapan Bajet 2016 - Perbendaharaan Negara

[6] Malaysia Economic Monitor: Toward A Middle Class Society - World Bank

[7] IMF Country Report - Malaysia (March 2015)

[8] Variations in Household Propensity to Consume Across Income Segment - Bank Negara

[9] Statistik Jalan Persekutuan 2009 - Jabatan Kerja Raya

[10] Buletin Perangkaan Sosial 2016 - Jabatan Perangkaan Negara

[11] Ucapan Bajet 2017 - Perbendaharaan Negara

[12] Ucapan Bajet 2012 - Perbendaharaan Negara

[13] Malaysia Cuts Overseas Study - Times Higher Education

[14] The Impact of Economic Crisis on Higher Education in Malaysia

[15] Kenyataan Akhbar KPK 14 November 2016: Pengemaskinian Caj Rawatan Hospital KKM: Hanya Untuk Caj Pesakit Dalam Kelas 1 dan 2

[16] MISC to Pay $220 Million Price For Assets From Mahathir's Son - WSJ